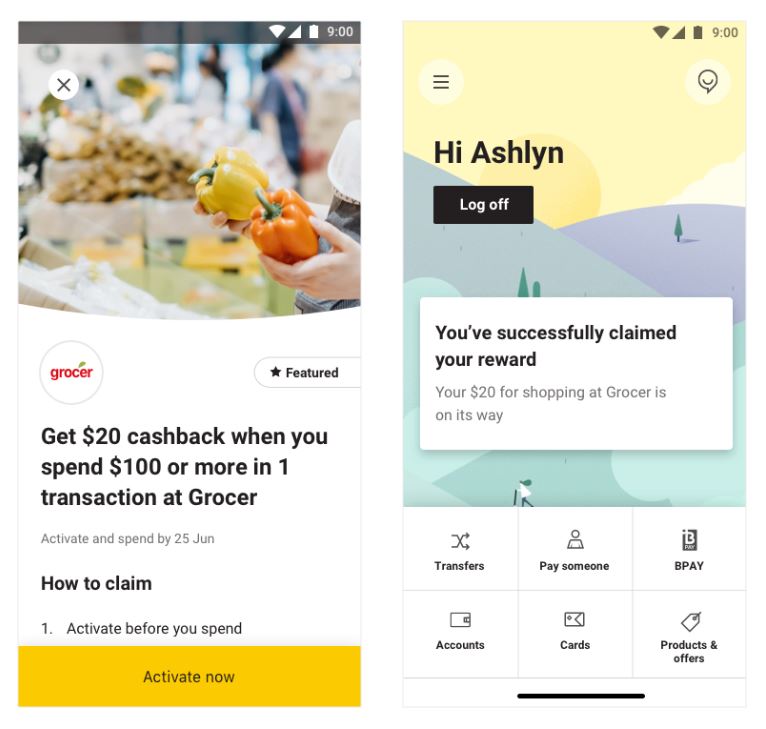

CommBank Mobile. CommBank Mobile is a banking application that will answer your daily financial needs. Find various conveniences in banking transactions. I love Commonwealth Bank, the staff are helpful, and I like that they were happy to match other bank's rates on the term deposit if you ask. You can view the rates online so you can compare with other banks, and when it matures they send you a letter so you don't forget about it and you can renew it over the phone instead of going into the branch. A term deposit is where the interest rate is guaranteed not to change therefore your savings grow over the year. If you have a long term savings goal perhaps for a house or an overseas holiday, a 12 month term deposit is a good way to achieve those financial ambitions. The key features of a 12 month term deposit? Lock away savings at a fixed rate. This could be for you if you want: To leave your savings untouched for a certain amount of time; An investment with a fixed rate of return; To invest from $5,000 to less than $2,000,000 Open now.

Mobile Banking is a banking online service for customers who are accustomed to use smartphones to communicate (ie: iPhone and Android) and it’s enabling to perform banking transactions anywhere and anytime, without having to visit a branch office.

Benefits:

- Easy: Using the same user ID and static password as your Internet Banking

- Safe: Using static password to login and authenticate transactions using Token

- No fee: Free of charge for register and use token for customers. Mobile Banking is only using a GPRS connection, so the connection is depend on the telephone operator/provider’s client.

Product Risk

The failure of the Digital Services system (Internet Banking, Mobile Banking) Bank (system down/system error).

Procedures & requirement:

- Subscribe for Internet/Mobile Banking service in nearest Commonwealth Bank branch by completing and signing the product & services application form and providing the required documents.

- For customer who’s opening the account at Commbank e-Kiosk, will be automatically registered to Internet and Mobile Banking and will receive username and password for the Internet and Mobile Banking.

- Download Mobile Banking application:

- Android: search “Commbank ID” pada Google Play Store

- iPhone: search “Commbank ID' pada AppStore

- Login using given username and static password, same as your Internet Banking.

Product FeaturesInquiries

- Balance Inquiry for transactional account

- Balance inquiry for Investment account (CommInvest)

- Account Movement

- Transaction History

- Active Term Deposit Inquiry

- Standing Order Inquiry

- Loan Details

- Loan Account Activity

- Loan Payment History

Fund transfer

- Fund transfer to your own account or to other’s account in Commonwealth Bank with cross currency between IDR, USD, AUD, SGD, EUR, GBP, CNY, NZD, HKD and JPY.

- Fund transfer in IDR to domestic banks using SKN, RTGS and Online transfer method

- Fund transfer in foreign currency using SWIFT to domestic or overseas (currently available in AUD and USD)

- Future dated fund transfer

- Standing Order fund transfer

Notification to Beneficiary

You can send notification to your receiver via email to inform that fund transfer has been done

Mutual Fund

- Subscription Mutual Fund

- Redemption Mutual Fund

- Switching Mutual Fund

- Inquiry for Mutual Fund product include NAV history

- Inquiry for Mutual Fund order status

- Inquiry for Mutual Fund portfolio

Bill Payment

Hassle-free feature for your monthly bills payment and many kinds of pre-paid vouchers purchase.

Post-paid Telecommunication Bills

- Telkom - PSTN

- Bakrie Telekom - Esia

- SmartFren

- Hutchison - Tri

- XL/AXIS

- XL Xplor

Internet Monthly Bills

- Telkom Speedy

Prepaid Voucher

- Indosat Ooredoo

- Bakrie Telekom - Esia

- SmartFren

- Hutchison - Tri

- XL Axiata - XL Bebas, XL/AXIS

Entertainment Voucher

- CGV Pay

Pay TV

- Gen Flix Pre-Paid

Cheque/Giro book order

Online cheque/giro book order

Commbank Term Deposit Rates Pdf

Mailbox

allows user to view the general messages sent by the bank and allows user to send messages to the bank and view the sent messages.

Others

- Change Password

- Change User ID

- Change Security Questions

- Set favorite transactions

- View Transaction Status

- Forex Calculator and Loan Eligibility Calculator

- Information on Forex Rate

Special Rate

Cross currency transaction with special rate using deal code.

Transaction Limit

- Daily limit for each type of transaction

- No maximum limit transaction for Mutual Fund transaction

Fees and Charges

For more detail of Mobile Banking fees and charges, please look at Fees and Charges. For Mutual Fund transaction fee please refer to Mutual Fund Fee and Charges table

Bilingual

Mobile Banking service is available in Bahasa Indonesia and English version.

For further Information please Contact Call Commbank at (code area) 1500030 or (6221) 2935 2935 for International Access.

Terms and Conditions apply

Customer is fully responsible to every transaction instruction using User ID, static password and Token. Therefore Customer guarantee and discharge Bank from every claim and lawsuit arise from loss due to Mobile Banking Usage

- Individu Guidelines

- Corporate Guidelines

Term Deposit is a product for individual and corporate that can support the growth of your savings

Benefits:

| - | Available in a wide selection of currencies (IDR/AUD/USD). |

| - | Affordable minimum initial deposit. |

| - | Competitive interest rate. |

| - | Convenience in transaction through Internet/Mobile Banking with discount for transaction fee including: |

| - | Term Deposit Advice as a confirmation of placement, renewal, maturity / termination of the Term Deposit. |

Easy Time Deposit (TD) Transactions through Phone Indemnity / POI and Enjoy the Benefits:

- Ease of doing transaction anywhere without coming to branch.

- Customer is not required to sign any form. Customer is only required to confirm the transaction by Phone with our Relationship Manager (RM).

- Faster transaction processing and Time Efficient.

Deposit transaction options include: Time Deposit Placement, Time Deposit Prepayment and Time Deposit Termination.

Risk of Product

One of the risks attached in Term Deposit product is the changes in fees that can be done at anytime and it will be informed to customers through branches, website or other media deemed appropriate by the Bank.

Procedures and Requirements

Opening a Term Deposit can be done at the nearest Commonwealth Bank branch by completing and signing the account opening application form and providing the required documents or through Internet Banking (for existing customers).

Document Requirement:

| Resident | : | Valid ID (KTP) |

| Non Resident | : | Passport; and KIMS/KITAS/Reference letter from company/Reference Letter from Commonwealth Bank of Australia (CBA) |

| Institution | : | Documents requirement according to Terms and Conditions applied by Commonwealth Bank |

| Description | Fee |

| Initial deposit | IDR 50,000,000 or AUD/USD 5,000 |

| Break fee (if break before time to maturity) | 0,5% from Principal, interest is not paid.** |

*Fees and Charges is subject to change and it will be informed to customers through media deemed appropriate by the Bank.

**Early Break Time Deposit before maturity, the ongoing interest paid will be deducted from the principal

Interest Rate Calculation

Interest is calculated based on end of day balance according to the prevailing interest rate. Interest rate table can be access in here

Product Expiration

The expiry of the product will be when customer or Bank closes the account.

Commbank Term Deposit

Product Issuer

This Product issued by PT Bank Commonwealth and guaranteed by Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS')***

***If the value of total deposit exceeds maximum value/if the interest rate of deposit exceeds interest rate of Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS'), deposit is not included and/or shall not be guaranteed by LPS in Deposit Insurance Scheme/Program Penjaminan Simpanan.